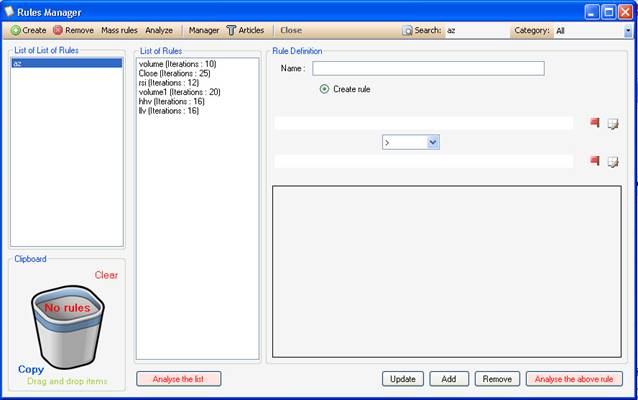

1. Rules Manager The Rules

manager allows you to manage and create easily and quickly as many rules as you

want. A rule is a

formula that can be used in charting, simulation... You can

create undefined variables within a rules and specify the start, the end

and the increment value of these variables. List of

rules can be used in many situations. Examples: Open the

rule manager (Analysis -> Rules Manager) Here is how

to create a rule.

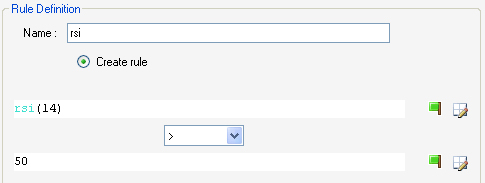

A red flag

means that there is an error in the formula, if everything is ok then the red

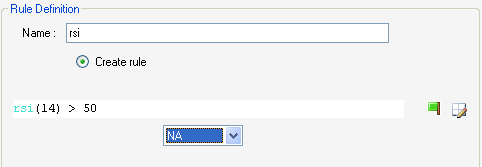

drag will turn into a green one. In the

combo box you can select NA, and then type directly the formula in the first

input

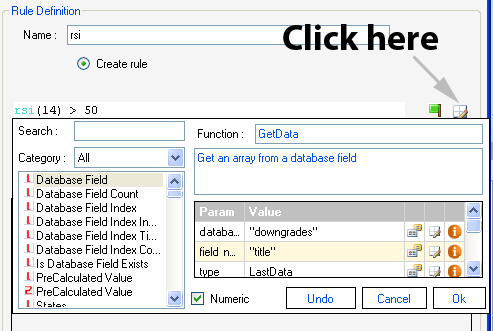

When you

click on the icon next to the red flag, a small form will appears.

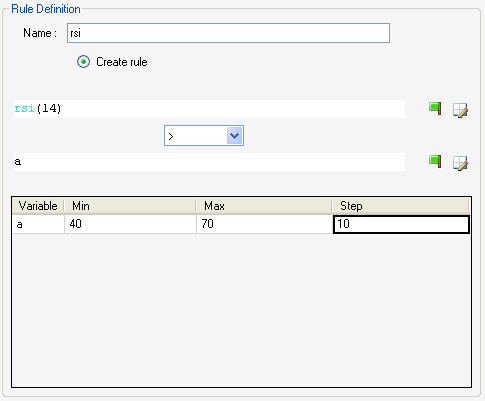

The grid below the inputs boxes is used to

transform one rule into several ones. Example:

instead of specifying rsi (14) > 50, you can type rsi (14) > a to make a

line in the grid appears.

Type in the

minimum, the maximum and the step value 1.3. Rules

Manager Open the

rule manager (Analysis -> Rules Manager)

You can

drag and drop rules or list of rules by selecting a rule or a list of rules and

dragging it to the clipboard.

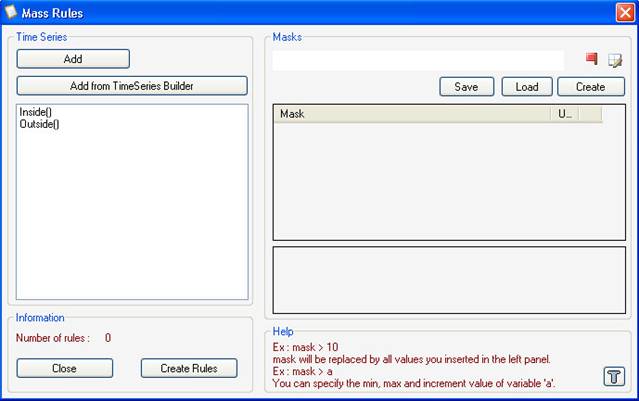

'Mass

rules' is a tool that will help you create many rules very quickly using masks. Now you

have two ways to add functions:

The added

functions will appear on the left list.

You can now

create your masks and specify variables within masks if needed. Type for

example: mask > ref(mask, a) then click on Create, and make variable "a"

varies from one to 10 with one as a step. We are about now to create 20 rules

(2 rules and ten iterations for each rule) After

clicking on "Create Rules", two rules will be created (with 10 iterations for

each rule) Inside() > ref(Inside(), a) Analyze

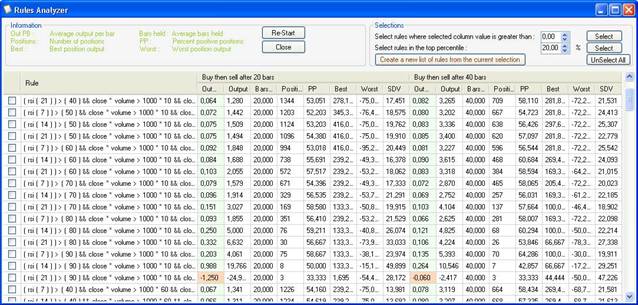

rules is a tool that will let you back-test your rules one by one before using

them in ranking systems, simulation, neural networks... Select a list of rules then click on Analyze,

the settings dialog box will appears. 1.6.1.

Symbols & Periods

1.6.2.

Filter

1.6.3.

Outputs

The outputs

form appears once you click on the "Select Outputs" button. 1.6.4. Fixed Rule You can

specify a fixed rule that will be added to the rules to be analyzed. Let us say

we want to analyze theses rules:

As a fixed

rule, we have: You will

end up with a total of "1 + (1 * 2)" rules multiplied by 2 (fixed rules) for a

total number of six rules. close >

10 && Rsi(14) > 10 close >

10 && Perf(close, 10) > 2 close >

10 && Perf(close, 10) > 4 close >

20 && Rsi(14) > 10 close >

20 && Perf(close, 10) > 2 close >

20 && Perf(close, 10) > 4 1.6.5. Metrics Jscript.Net

formula is used to create metrics. Example of

metric formula: Set the output to zero if the number of

position generated by the rules is lower than one hundred. 1.6.6. Results When

analyzing rules completes, a grid containing the results appears.

· Out PB: Average position outputs per

bar · Output: Average position outputs · Bars held: Average number of bars

per position · Positions: Number of positions · PP: Percentage of positive position

output · Best: Best position output · Work: Worst position output · SDV: Standard deviation of position

outputs You can

easily create new list of rules from the analyzed rules.

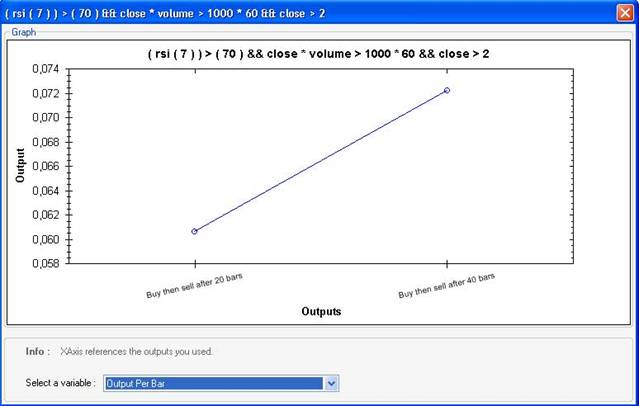

Search: Graph per Output: Display a

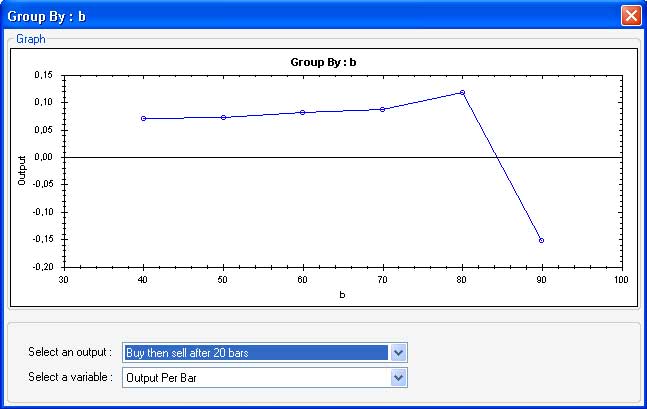

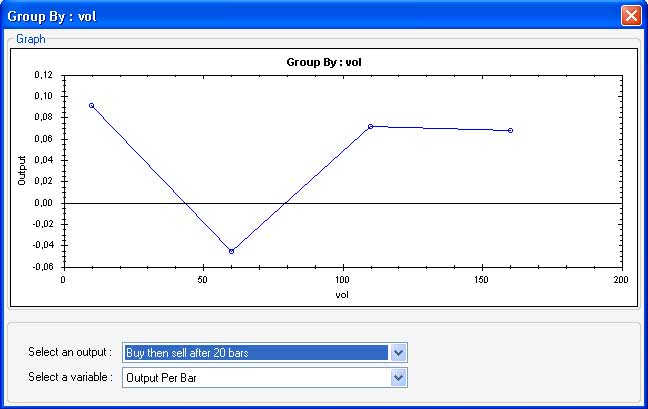

chart that plots the analyzer results per Output. Group results per variable: Display a

chart that plots the analyzer results per variable value. |

|

|

|

|